Community Volunteer Income Tax Program (CVITP)

Visit our Web page at http://www.cra-arc.gc.ca/volunteer/ or call 1-800-959-8281 (English) or 1-800-959-7383 (French)

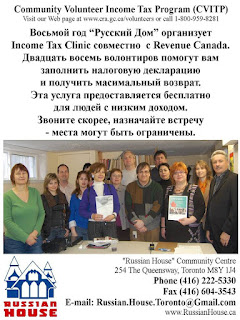

Восьмой год "Русский Дом" организует

Income Tax Clinic совместно с Revenue Canada.

Двадцать восемь волонтиров помогут вам

заполнить налоговую декларацию

и получить максимальный возврат.

Эта услуга предоставляется бесплатно

для людей с низким доходом.

Звоните скорее, назначайте встречу

- места могут быть ограничены.

For the last eighth years “Russian House"

together with Revenue Canada

have organized an Income Tax Clinic.

Twenty-eight volunteers will help you

to complete your tax return

and to get the maximum tax refund.

This service is provided free of charge

for people with low incomes.

Call (416) 222-5330 for appointment

- Please note that appointments are limited.

"Russian House" Community Centre

Address: 254 The Queensway, Toronto ON, M8Y 1J4

Main Intersection: the Queensway & Stephen Dr. or Park Lawn Rd.

How to get us : Bus # 66A, D from Old Mill Subway Station

Bus # 80 from Keele Subway Station

Streetcar #501, Hamberloop Stop

Phone: (416) 222-5330

Fax: (416) 604-3543

E-mail: Russian.House.Toronto@Gmail.com

Web: www.RussianHouse.ca

Community Volunteer Income Tax Program

The Community Volunteer Income Tax Program provides eligible individuals with free help in completing their tax returns.

Delivered by: Canada Revenue Agency (CRA)

Eligibility Information

Participants must meet the following criteria:

- be unable to complete their income tax and benefit return by themselves

- be unable to pay for assistance

- other criteria may apply

Contact the Canada Revenue Agency.

http://www.cra-arc.gc.ca/contact/menu-e.html

Related Information

- Volunteers do not complete income tax and benefit returns for deceased persons, bankrupt individuals, or individuals who have capital gains or losses, employment expenses, or business or rental income and expenses.

- The Clinics are offered between February and April of each year in various locations across Canada.

Description: Prepares basic income tax returns for individuals with low income

Service Details: Volunteers prepare basic income tax returns enabling individuals to file for benefits they otherwise would not receive

* Volunteers should have experience in preparing basic tax returns

* A one day training session is provided each year to volunteers

Dates: Most activity is during the tax filing season from March to the end of April.

Eligibility: Individuals with low incomes and the inability to complete their own return

* Inability to pay for assistance

* Net Income of less than $30,000 for a couple

* Have a simple tax return

Fees: Free; Organizations that offer this free service may have a donation box to assist in covering costs of supplies or to make a charitable donation.

The Canada Revenue Agency offers, through its Community Volunteer Income Tax Program, free volunteer tax training sessions to community organizations and individuals and provides volunteers with a kit of handy reference material. For further information, call the Canada Revenue Agency at 1-800-959-8281.